Your Path to Higher Education Success

Empowering students with insights and guidance for college degrees.

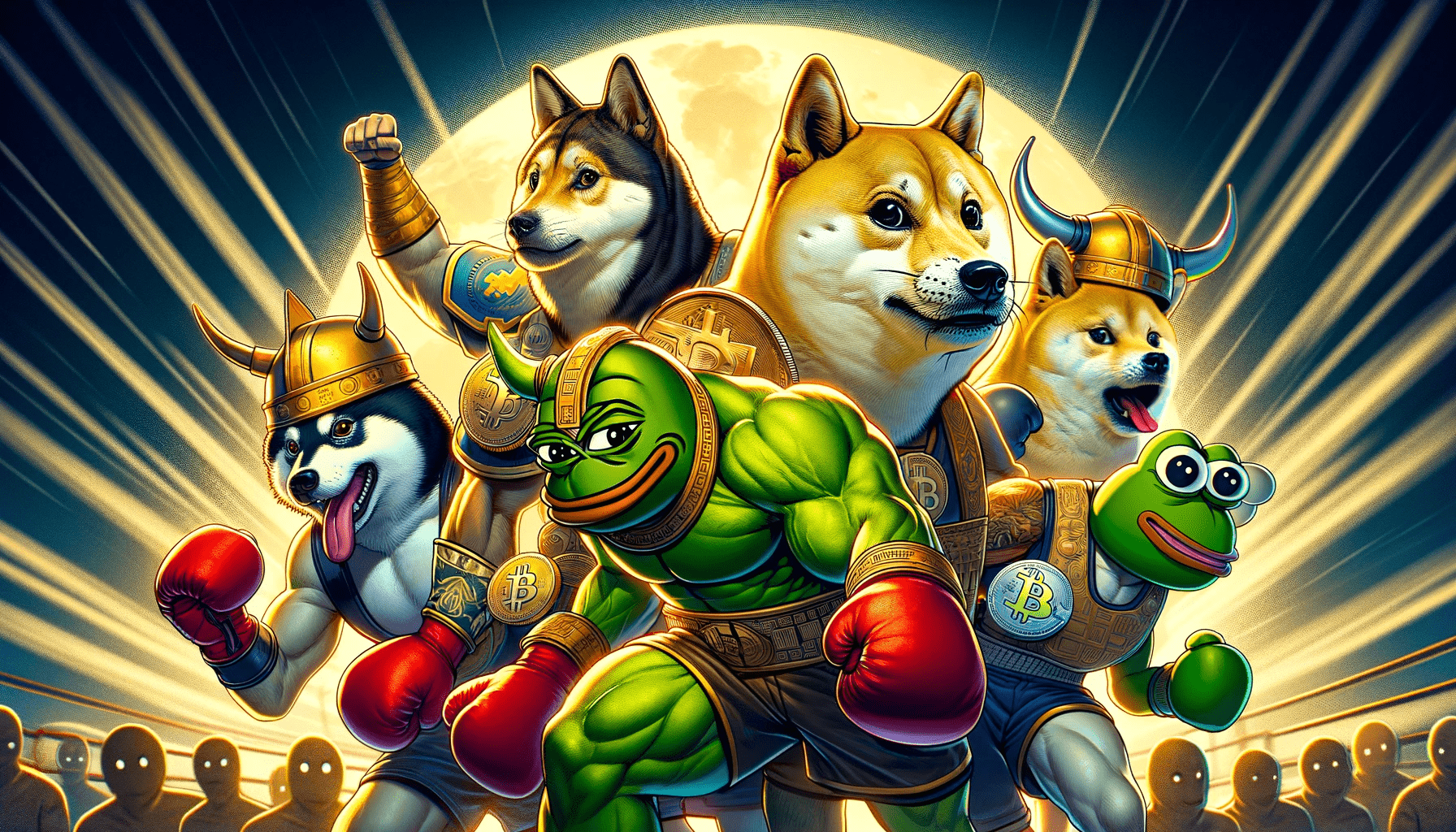

Meme Coins: The Joke that Became a Fortune

Discover how meme coins went from laughs to massive fortunes—uncover the next big trend in crypto today!

Understanding Meme Coins: How Humor Turned into Wealth

Meme coins have emerged as a fascinating intersection between pop culture and cryptocurrency, blending humor with the potential for wealth. Initially, they began as jokes or parody tokens, often inspired by popular internet memes like Dogecoin. However, these cryptocurrencies quickly gained traction, attracting attention from both seasoned investors and casual individuals who were enticed by the lightheartedness of the space. The rise of platforms like Reddit and Twitter amplified their visibility, creating communities where people could bond over both humor and the possibility of financial gain.

What sets meme coins apart from traditional cryptocurrencies is not just their humorous origins but also their ability to create a sense of community. Investors often rally behind a shared joke or theme, leading to organic growth and market interest. Even though their value can be volatile and heavily influenced by social media trends, the sheer enthusiasm that surrounds these coins has turned many into overnight success stories. This phenomenon illustrates how a playful approach to finance can result in significant wealth creation, showing that in the world of cryptocurrency, humor can indeed be a serious business.

Are Meme Coins a Serious Investment or Just a Trend?

The rise of meme coins has taken the cryptocurrency world by storm, capturing the attention of both seasoned investors and newcomers. Initially born from internet culture and social media trends, these digital assets often feature humorous themes or are inspired by popular internet memes. However, their rapid ascent often raises questions about their legitimacy as a serious investment. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are backed by robust technologies and use cases, many meme coins lack a solid foundation and are driven primarily by hype and community sentiment.

Investing in meme coins can feel like a thrilling adventure, but it also carries significant risks. Their value can fluctuate wildly in a short timeframe, making them highly speculative assets. While early adopters of certain meme coins have made impressive gains, countless others have seen their investments evaporate as trends shift. Therefore, it's crucial for potential investors to conduct thorough research and consider their risk tolerance before diving into this space. Ultimately, the question remains: Are meme coins a serious investment or just a trend? For those who choose to invest, a cautious and informed approach is essential.

The Rise of Meme Coins: What You Need to Know Before Investing

The rise of meme coins has taken the cryptocurrency world by storm, capturing the attention of both seasoned investors and newcomers alike. Originally created as a joke or parody, these coins have found unexpected popularity, often driven by social media trends and community-driven movements. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are backed by technology and use cases, meme coins like Dogecoin and Shiba Inu often gain value through hype and speculative interest. Understanding this phenomenon is crucial for anyone considering entering this volatile market.

Before investing in meme coins, it is essential to conduct thorough research and be cautious about the risks involved. Here are a few key points to consider:

- Market Volatility: Meme coins are notoriously volatile, with prices that can fluctuate wildly within short periods.

- Community Influence: The value of these coins can be significantly affected by online communities, social media influencers, and trends.

- Lack of Fundamentals: Many meme coins lack intrinsic value or utility, making them more akin to speculative assets.