Your Path to Higher Education Success

Empowering students with insights and guidance for college degrees.

Climbing the Cashback Ladder: How Loyalty Tiers Can Inflate Your Wallet

Unlock hidden savings as you ascend the loyalty tiers! Discover how cashback rewards can fatten your wallet in ways you never imagined.

Maximizing Your Rewards: A Deep Dive into Cashback Loyalty Tiers

When it comes to maximizing your rewards, understanding cashback loyalty tiers can significantly enhance your earning potential. Many cashback programs operate on a tiered system where the percentage of cashback you earn increases based on your spending levels. For instance, a common structure might look like this:

- Tier 1: $0 - $500 spent = 1% cashback

- Tier 2: $501 - $1500 spent = 2% cashback

- Tier 3: $1501+ spent = 3% cashback

By strategically planning your purchases to reach higher tiers, you can substantially increase your overall rewards.

Moreover, it’s essential to pay attention to the terms and conditions of each cashback loyalty program to fully understand how you can progress through the tiers. Some programs may provide bonus opportunities based on special promotions or specific categories, such as groceries or gas, which can further boost your cashback earnings. Don't hesitate to leverage these opportunities; sometimes, just shifting your spending to a different category can mean earning extra rewards. Ultimately, knowing how to navigate and maximize cashback loyalty tiers will ensure that you get the most out of your purchases and turn everyday spending into lucrative rewards.

Counter-Strike is a popular first-person shooter game that pits two teams against each other: the Terrorists and the Counter-Terrorists. Players can choose various roles and weapons while engaging in objective-based gameplay. To enhance your gaming experience, you might want to check out the clash promo code available for exclusive in-game benefits.

The Hidden Benefits of Loyalty Programs: How to Climb the Cashback Ladder

Loyalty programs are often seen as simple customer retention tools, but they offer a plethora of *hidden benefits* that can significantly enhance your shopping experience. By participating in these programs, consumers can unlock exclusive rewards, access special promotions, and even enjoy personalized offers tailored to their shopping habits. Moreover, these programs often incentivize consumers to reach certain spending thresholds, making it easier to earn points or cashback faster. In essence, each purchase could be a step towards climbing the cashback ladder, turning everyday expenses into opportunities for savings.

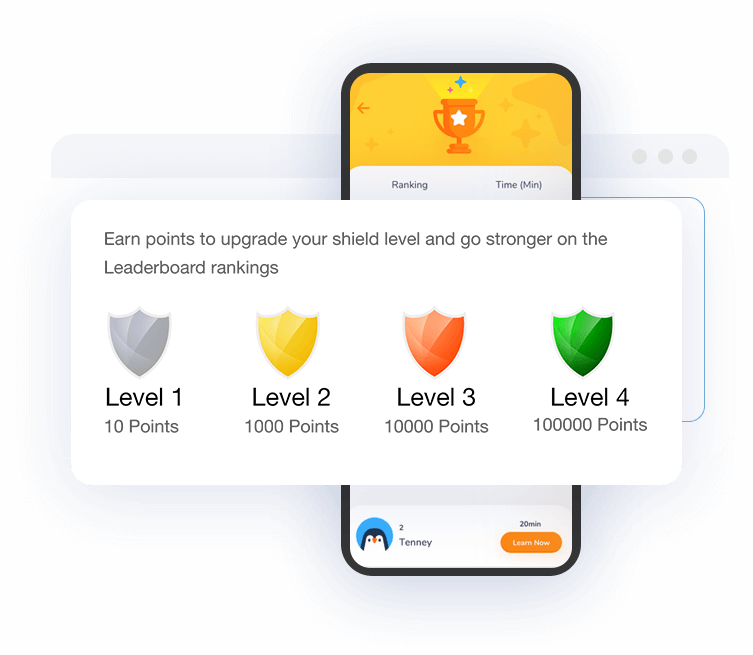

Beyond immediate rewards, loyalty programs can also lead to substantial long-term benefits. For instance, many brands offer tiered loyalty systems, meaning the more you engage with a brand, the greater your rewards. This could manifest in enhanced cashback rates or exclusive experiences like first access to sales and special events. Additionally, some programs partner with other companies, allowing you to earn points across multiple platforms. Thus, by strategically leveraging these programs, consumers not only enjoy enhanced value on their purchases but can also *maximize their cashback potential* across a wider network of services.

Is It Worth It? Understanding the Value of Loyalty Tiers in Cashback Programs

In today's competitive market, cashback programs have become increasingly popular, offering consumers various incentives to shop with specific retailers. One of the most enticing features of these programs is the loyalty tier system, which rewards users based on their spending habits. Understanding the value of loyalty tiers is essential for savvy shoppers. These tiers typically offer benefits that increase as you progress, including higher cashback percentages, exclusive discounts, and access to special offers. As you navigate your shopping experience, it is important to assess whether the potential rewards justify the required spending to reach higher tiers.

However, before diving into any cashback program, it's crucial to evaluate the terms and conditions that govern loyalty tiers. Some programs may require a significant financial commitment to unlock higher levels, while others may provide a more accessible approach. Consider creating a comparison chart that outlines the cashback rates, tier requirements, and any expiration dates on rewards. This way, you can make a more informed decision about whether the effort to reach these tiers aligns with your shopping habits and financial goals. Ultimately, the key lies in weighing the true benefits against your spending behavior to determine if it really is worth it.